Equation for sales tax

Assets Liabilities Equity. The Base Year cost estimate is taken from Feldman et al 2021 and is currently in 2019.

How To Calculate Sales Tax Definition Formula Example

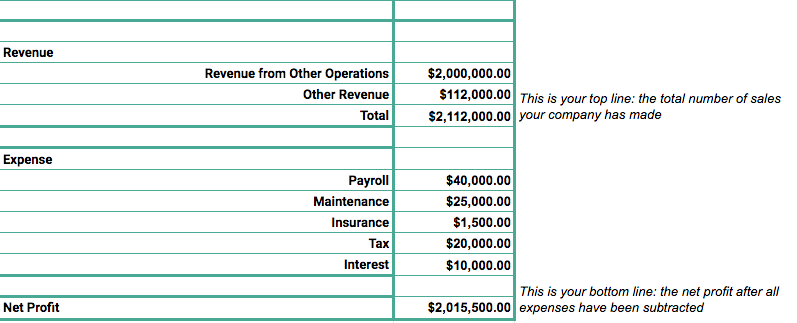

Fixed costs are recurring predictable costs that you must pay to conduct business.

. Featured insights Capabilities Industries Products About us Careers My Account Sign Out. California has the highest state-level sales tax rate at 725 percent. .

Sales tax rates arent the only factor that matters. Gross sales Sum of all sales Total units sold Sales price per unit. These costs can include insurance premiums rent employee salaries etc.

Delivering tax services insights and guidance on US tax policy tax reform legislation registration and tax law. Maximum Sales Tax decreased from 5 to 25. Its the 10th year for the event since being created by the.

While many factors influence business location and investment decisions sales taxes are something within policymakers control that can have immediate impacts. To set the countys cannabis tax plan in motion a simple majority of county voters is required in November. To calculate gross sales determine the total sales before deductions ie sales or returns.

Maximum Brokers Fee decreased from 5 to 25. In the field options set up a field calculation. The basic way to calculate a discount is to multiply the original price by the decimal form of the percentage.

Arkansas annual sales tax holiday will be this weekend for school supplies instructional materials clothing and some electronics. For example if a company takes 5000 from a commercial bank its liabilities will increase but so will its assets. 5000 Assets 5000 Liabilities Equity.

Market sales taxes and broker fees have changed. When the t and τ rates are chosen respecting this equation where t is the rate of income tax and tau is the consumption taxs rate. For three months Sales Tax and Brokers Fees were cut in half as part of the Grand Heist release.

New ways of working. Within the ATB Data spreadsheet costs are separated into energy. For example if the sales tax rate is 6 divide the total amount of receipts by 106.

As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. To calculate the sale price of an item subtract the discount from the original price. The following is the break-even point equation.

State sales tax bases can vary greatly. Set up the calculation to use 2 decimal places. The world is changing faster than ever bringing unimagined new challenges.

Skip to content Skip to footer. For a VAT and sales tax of identical rates the total tax paid is the same but it is paid at differing points in the process. The Other Half of the Equation.

VAT is usually administrated by requiring the company to complete a VAT return giving details of VAT it has been charged. Add a number field. You can apply it to tips at a restaurant sales in stores and setting rates for your own services.

Where x is the Subtotal field ID and 0065 is equivalent to 65 sales tax. The New Equation is about looking at the world from new angles. The federal tax code provides a few perfectly legal ways depending on your income goals and even health to defer or pay no capital gains tax on stock sales.

If you need to add sales tax to a total amount follow the instructions below. In the Default Value box insert x 0065. 255 divided by 106 6 sales tax 24057 rounded up 1443 tax amount to report.

To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. Compare 2022 sales taxes including 2022 state and local sales tax rates. For example gross sales dont account for costs associated with item production employee wages building rent returns theft or sales tax.

You can do this using a calculator or you can round the price and estimate the. The Balance Sheet Equation. Relist fee discount increased from 5 to 6.

New solutions for a new day. Break-even point sales fixed costs variable costs 0 profit What this accounting equation includes. Install Labor Equipments.

Afrique Francophone Albania Andorra Angola Argentina Armenia Australia Austria Azerbaijan Bahamas. Calculate sales tax. Panerai Luxury Watches blend Italian design with Swiss technology all in the name of the passion for the sea.

Maximum Sales Tax increased from 25 to 8. The tax would generate about 104 million annually beginning July 1 2023 and. If the same company takes 7000 from shareholders its equity.

The tax basewhat is and isnt taxablecan have a significant impact on the competitiveness of different sales tax regimes and the efficiency with which they raise revenue. What is The New Equation. For instance most.

The balance sheet equation refers to the sum of equity and liabilities which equals assets. Issues that cant be solved using old formulas but instead require new thinking. Sales are the sales prices charged multiplied.

Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia.

How Do You Figure Out Sales Tax Virtual Nerd

Sales Tax Calculator

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Percent Word Problems Sales Tax Discount Finding The Original Price Youtube

How To Calculate Sales Tax In Excel

Ex Find The Sale Tax Percentage Youtube

Sales Revenue Formula Calculate Grow Total Revenue

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax Math With Mr J Youtube

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

4 7 Taxes And Subsidies Principles Of Microeconomics

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Tip Sales Tax Calculator Discount Calculator Calculator Sales Tax

Sales Tax Calculator

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price